Over the past decade, the financial industry has undergone a significant transformation, driven by the rise of financial technology (fintech) and the concept of open finance. Fintech refers to the use of technology to improve and innovate financial services. Accessing services like mobile banking, payment, lending, budgeting and investing via mobile devices has exploded over the last few years, notably in Africa. Couple this with quickly evolving capabilities within open finance, which refers to the idea of using open data that enables the secure sharing of financial information between different institutions to benefit consumers, and we’re creating an open and inclusive financial system accessible to all. Together, these trends have had a major impact on the way that financial services are delivered and consumed and have opened up new opportunities for consumers and businesses alike.

Why are fintech and open finance on the rise? The answer is simple: access. Access to know-how, tools and capabilities via trusted and secure approaches. The financial world is changing, and technology is at the forefront of this transformation. Technology is levelling the playing field by making financial capabilities more accessible, convenient and secure for everyone.

Transforming Finance: The Impact of Fintech on Financial Management

In today’s rapidly evolving business landscape, technology is reshaping the financial landscape at an unprecedented pace. Financial technology, or fintech, has emerged as a disruptive force, revolutionising how businesses manage their finances. In this article, we’ll explore the profound impact of fintech on the financial sector and provide insights into how businesses can leverage technology for enhanced financial management.

1. Streamlined Payment Processing

One of the most notable contributions of fintech to financial management is the streamlining of payment processing. Fintech solutions enable businesses to accept payments through various channels, including online payments, mobile wallets, and digital invoices. This not only enhances the customer experience but also accelerates cash flow, reducing the time it takes to access funds.

Insight: Businesses can leverage fintech payment solutions to offer convenient payment options to customers and optimize their cash flow management.

ALSO READ: The Impact of Mobile Devices on the Future of Payments

2. Improved Access to Capital

Traditional lending processes can be slow and cumbersome. Fintech has introduced alternative lending models such as peer-to-peer lending, crowdfunding, and online lending platforms. These platforms provide businesses with quicker access to capital, allowing them to fund expansion, invest in innovation, or navigate cash flow challenges more effectively.

Insight: Explore fintech lending platforms to secure capital quickly and efficiently, tailoring loan terms to your business’s specific needs.

ALSO READ: Scale Your Business With Recurring Payments

3. Enhanced Financial Analytics

Data is the lifeblood of effective financial management. Fintech solutions offer advanced analytics tools that provide businesses with real-time insights into their financial health. These analytics can help identify trends, forecast cash flow, and make data-driven decisions to optimise financial performance.

Insight: Utilise fintech analytics to gain a deeper understanding of your financial data and make more informed, strategic choices.

4. Automation of Routine Tasks

Fintech automation tools can handle routine financial tasks such as bookkeeping, invoicing, and expense tracking. Automation reduces the risk of errors, saves time, and allows financial teams to focus on more strategic activities.

Insight: Implement fintech automation solutions to streamline financial workflows and improve operational efficiency.

5. Enhanced Security

With the rise of online transactions, security is a paramount concern. Fintech companies invest heavily in cybersecurity to protect financial data and transactions. Features such as multi-factor authentication and encryption ensure that financial information remains secure.

Insight: Prioritise fintech solutions with robust security features to safeguard your business’s financial data.

6. Personalised Financial Services

Fintech has made personalised financial services accessible to businesses of all sizes. Robo-advisors and financial management apps offer tailored financial advice, investment strategies, and savings plans, helping businesses make the most of their financial resources.

Insight: Explore fintech advisory services to optimise your financial strategy and investments.

7. Global Financial Accessibility

Fintech has transcended geographical boundaries, providing businesses with access to global financial markets and services. Cross-border payments, currency exchange, and international investment opportunities are now within reach for businesses of all sizes.

Insight: Leverage fintech solutions for international financial operations, expanding your business’s global reach.

The impact of fintech on the financial landscape is transformative. Businesses that embrace fintech solutions gain a competitive edge by improving payment processing, accessing capital, enhancing financial analytics, automating routine tasks, and ensuring security. By leveraging these fintech innovations, businesses can enhance their financial management, drive growth, and navigate the dynamic and technology-driven financial landscape with confidence.

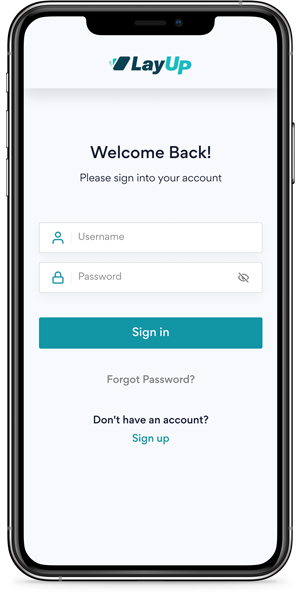

With LayUp, a leading fintech firm revolutionising lay-bys, you can:

Reduce admin costs:

LayUp’s cloud-based system automatically tracks, reconciles and collects all payments, handling the hassle for you.

Increase completion rates:

Open access to a wider audience with the credit-free payment solution that everyone can use. With interest-free instalments, LayUp completion rates increase by up to 60%.

Increase purchase value:

Average order values increase by up to 25% as payments are broken down into more affordable weekly or monthly payments.

Connect LayUp to your business software to enjoy seamless and secure transactions.