Business FAQs

What are payment solutions for merchants?

Payment solutions for merchants are a range of different options that allow businesses to accept payments from their customers. These can include traditional payment methods, such as credit and debit cards, as well as newer technologies like mobile wallets or online payment platforms.

Additionally, many payment solutions offer additional features, such as advanced fraud protection or multi-currency support, which can help businesses manage risk and streamline their processes.

- Using LayUp

- Payments & Collections

- Integrating with LayUp

- Security

- Customer Experience

- Our plugins or Custom API – Integrate LayUp seamlessly into your website and start accepting payment plans for your online store. The LayUp plugin is available on Shopify, Woocommerce, and Magento or you can directly integrate with our cloud-based API for custom websites.

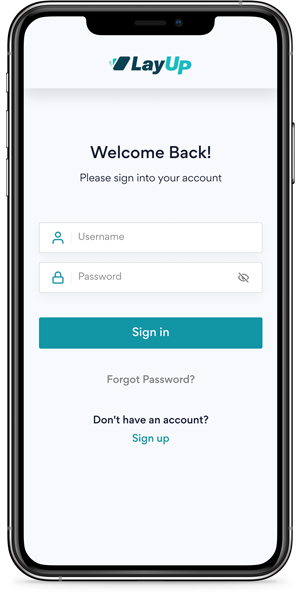

- Our iOS/Android merchant App – Available on the App stores to download for FREE or request to get set up with a Newland N910 card machine to start offering digitised Lay-By payments in-store.

- Our dashboards – LayUp provides access to a full treasury dashboard to easily allow merchants to view, manage and retrieve their customer’s payment plan history as well as allowing merchants to be able to create personalised Adhoc payment plans.

LayUp is the first recurring payments system to offer a fully cloud-based digitised Lay-by, subscription, membership & debit order payments system in Africa.

Our omnichannel technology and easy to use dashboards make LayUp a powerful solution for everyone from innovative SMEs to large corporations.

We service both online and in-store SME merchants with smart technology that enables them to transition their payment offering onto a more robust scalable solution.

LayUp is designed to service large to enterprise businesses with more complex structures and multi-level integration requirements that need a more tailored integration approach.

LayUp is great for pre-payment plans, Lay-By, subscriptions, membership and debit orders. However, we aren’t able to Offer;

- Credit Solutions – such as BNPL or revolving credit. We are not a registered FSP and we believe in true interest-free payments

- Foreign Companies – We only service companies who trade and bank in ZAR at this point. We plan to expand globally soon. Get in touch

LayUp accepts Card(debit/Card), Cash, EFT, recurring debit order payments

- Result Driven: At LayUp our most important asset is our technology and therefore we ensure we do everything in our power to make sure our tech stack is working and scaling for merchants at all times.

- We remove your admin: LayUp will remove and reduce the admin of collecting, managing and reconciling piecemeal payments over time. LayUp removes the hassle of following up and chasing for your payments.

- Simple Pricing Model: Refer to our website to learn more about our pricing options.

- Transparent communication: A big part of LayUp is for us to make prepayment offerings, clear and transparent to both the merchant and their customers at all times.

- Our Support Team: LayUp goes above and beyond when it comes to being there when help is needed.

Yes, LayUp is PASA (Payment Association of South Africa) approved as a TPPP (Third Party Payment Provider), through Bankserv. We have proudly been a member of PASA for 3 years and we will continue to follow and abide by the constructs of this association.

- Lay-By payments

- Subscription payments

- Recurring payments

Lay-By payments – This is when a merchant allows their customers to secure an item with a small deposit and spread the remainder of the amount over a period of time. The merchant is required to reserve and hold the purchase for that customer at the selling price and is not allowed to charge interest.

Subscription payments –

Recurring payments –

No, you can accept any limit through LayUp.

LayUp settles all payments via direct bank transfers. The settlement files provide all the relevant information of every transaction collected, reconciled and settled.

We have 3 various settlement structures that we can provide. These are listed below.

- Settlement A – LayUp settles Merchant for ALL payments received prior to completion of the payment plan.

- Settlement B – LayUp settles DEPOSIT payments and payments received for COMPLETED and CANCELLED payment plans

- Settlement C – LayUp settles payments received for COMPLETED and CANCELLED payment plans only

LayUp accepts Card(debit/Card), Cash, EFT, recurring debit order payments

- Lay-By payments

- Subscription payments

- Recurring payments

Lay-By payments – This is when a merchant allows their customers to secure an item with a small deposit and spread the remainder of the amount over a period of time. The merchant is required to reserve and hold the purchase for that customer at the selling price and is not allowed to charge interest.

Subscription payments –

Recurring payments –

Yes, you can. You have full flexibility to set up the payment plan the way you want to that best suits your business and customer.

Yes, this is called an amendment. You can easily amend the payment plan when necessary

We notify in a few different places.

- Via email notification to a dedicated email address

- Via your merchant dashboard, whereby you can via and see all upcoming payments

- Via a contact centre, where merchant support will assist you

Yes – Customers can pay on any device. Our payment pages will work in any up-to-date internet browser with internet connectivity.

After signing up, we recommend that you do a payment test yourself. It takes minutes, is risk-free and will assist you in learning about the LayUp customer journey.

LayUp is an authorised TPPP and PASA Approved.

The money collected is held in a secure client monies account.

LayUp understands the importance of security, and as such, takes every measure in maintaining data protection for merchants and their customers.

- Our partnership with DebiCheck means that our systems are approved by major banks within South Africa.

- We have TPPP certification and are PASA approved

- Encrypted client-server communication

All money that is collected is held in a secure account.

Yes.

We have TPPP certification and are PASA approved.

No. By law, customers are required to fill in their payment details and go through the signup process themselves.

Yes.

Your customer can enter their bank details online via the LayUp website.

Only once authorisation is in place. Customers must be sent to our secure payment pages to give initial authorisation of the Direct Debit.

Once authorisation is in place payment can be requested via the API.

What different types of payment solutions are available for merchants?

There are a variety of different payment solutions available for merchants, including traditional credit and debit cards, electronic wallets, and alternative payment methods such as cryptocurrencies. Each of these solutions has its own benefits and drawbacks, depending on the needs of the merchant and their customers.

Credit and debit

Traditional credit and debit cards are widely accepted by both online and offline merchants, making them a convenient choice for many businesses. However, they can be costly to process due to high transaction fees and may not offer the security or fraud protection that some merchants require.

Electronic wallets

Electronic wallets are another popular option for merchants looking to streamline the checkout process for their customers. These digital payment methods typically store payment information in a digital wallet that can be linked to a variety of online and mobile platforms, making it quick and easy for customers to make purchases. However, these wallets are only as secure as the devices they are stored on, which may pose a risk for some merchants.

Alternatives

Finally, alternative payment methods such as cryptocurrencies offer an attractive option for merchants looking to reduce transaction costs and increase security. While cryptocurrencies can be somewhat complex to set up and use, their decentralised nature makes them less vulnerable to fraud and fewer processing fees mean greater savings for merchants. Ultimately, the best payment solution for a merchant depends on their unique needs and priorities as well as the preferences of their customers.

The benefits of payment solutions for merchants?

Payment solutions are a key component of any successful ecommerce business, offering merchants a number of benefits that can help them improve their sales and streamline their operations. Some of the main advantages of payment solutions include increased efficiency, greater security, more streamlined processes, and better customer service. By utilising these solutions effectively, merchants can grow their businesses and become more competitive in today’s rapidly changing marketplace. Some of the benefits include:

- Lower processing fees, increased security, and improved customer satisfaction.

- By using a payment solution, merchants can rest assured that their customer’s data is safe and secure.

- Payment solutions also help to improve customer satisfaction by making it easy for them to pay for products and services.

- Merchants who use a payment solution can enjoy reduced processing fees, thanks to the discounts offered by many providers.

- Finally, using a payment solution can help businesses grow by providing them with the tools they need to accept payments online and offline.

How can Lay-Up payment solutions help merchants?

Lay-Up payment solutions are designed to help merchants manage and process their transactions more efficiently. With features like real-time processing, detailed reporting and analytics, and reliable security measures, Lay-Up can help streamline your business operations and maximise profitability. Whether you’re looking to accept payments online or in-store or need a solution for recurring billing or international transactions, Lay-Up has the tools you need to succeed.

Payment solutions for businesses – Frequently Asked Questions

How do I set up a payment system for my business?

Setting up a payment system for your business can be a complex process, but there are several key steps that you can follow to help make the process as seamless and efficient as possible. Some of the key considerations include choosing a payment processor, setting up merchant accounts with your bank or credit card provider, configuring your checkout process, and ensuring that you have strong security measures in place to protect your customer data.

Or, just come to LayUp – we’ll handle the hassle for you.

How do I accept payments for my small business?

To get started, you will need to apply for a merchant account with a payment processing service provider. This process typically involves submitting some basic information about your business and providing proof of identification or banking information. Once your application has been approved, you can begin accepting payments from customers using the various payment methods offered by your chosen processor.

What is the best payment method for an ecommerce business?

When it comes to choosing the best payment method for an ecommerce business, there are a number of factors to consider. Some of the most important considerations include transaction fees, security and ease of use.

Ultimately, the best payment method for your ecommerce business will depend on a number of factors, including your budget and the needs of your customers. To make the most informed decision about which payment method is right for you, it’s important to do your research and consider all of your options carefully.

At LayUp, when it comes to payment technology, we guarantee no risk, just revenue. So, come to us for progressive payment solutions that will fast-track your business’s growth.

Contact us

Still need some help?

Get in touch with someone from our team

who will be able to assist.