Mobile devices have become an essential part of modern society, providing people with access to the internet, communication, and various applications.

Now, the rise of mobile devices has also led to the emergence of mobile payments, which have revolutionised the way people make transactions. Mobile payments are transactions made using mobile devices, including smartphones and tablets, to transfer money or pay for goods and services.

In this article, we will explore the benefits and challenges of mobile payments, as well as their impact on society, particularly in emerging markets, and what this all means for your business.

Benefits of Mobile Payments

Mobile payments offer numerous benefits that have made them increasingly popular among consumers and merchants alike. Some of these benefits include:

Increased convenience and accessibility: Mobile payments allow people to make transactions anytime, anywhere, using their mobile devices. This has eliminated the need for physical cash or cards, making transactions faster and more convenient.

Improved security features: Mobile payments come with enhanced security features such as encryption, tokenisation, and biometric authentication, making them more secure than traditional payment methods.

Cost savings for merchants: Merchants can save on transaction fees and hardware costs associated with traditional payment methods, such as point-of-sale (POS) terminals.

Challenges of Mobile Payments

Lack of Standardisation and Compatibility: One of the most significant challenges facing mobile payments is the lack of standardisation and compatibility between different payment systems. With so many different mobile payment options available, consumers often face confusion and frustration when trying to make a payment. The lack of a standard platform makes it difficult for businesses to implement mobile payments, leading to slower adoption rates.

Security Concerns and Fraud Risks: Mobile payments are also vulnerable to security concerns and fraud risks. As mobile payments become more popular, hackers and cybercriminals have become increasingly sophisticated in their attempts to steal user data and commit fraudulent activities. As a result, security and fraud prevention measures are critical to ensure the safety of both consumers and businesses.

Slow Adoption Rates in Certain Regions: Finally, mobile payments have been slow to gain traction in certain regions of the world, particularly in developing countries with limited infrastructure and access to technology. The lack of access to smartphones and reliable internet connectivity in these regions poses a significant challenge to the widespread adoption of mobile payments.

Mobile Payments in Emerging Markets

Mobile payments have revolutionised the way financial transactions are conducted in emerging markets. With the ability to make secure and convenient transactions without the need for traditional banking services, mobile payments have become a powerful tool for financial inclusion.

Mobile payments as a tool for financial inclusion

Mobile payments have become a game-changer in the world of finance. They provide a convenient and secure way for people to make transactions without the need for cash or traditional banking services. This is especially important in emerging markets where financial inclusion is a major challenge. With mobile payments, people who previously had no access to financial services can now participate in the economy.

The impact of mobile payments on emerging economies

Mobile payments have had a profound impact on emerging economies. They have helped to reduce the cost and time associated with financial transactions, which has led to increased economic activity. Additionally, mobile payments have provided a way for small businesses to accept payments without the need for expensive infrastructure. This has led to the growth of small and medium-sized enterprises (SMEs) and increased job opportunities.

Future Trends in Mobile Payments

As mobile devices continue to permeate our daily lives, it’s no surprise that mobile payments have become increasingly popular. In fact, the mobile payments market is expected to reach into the trillions globally by 2023. This growth is expected to continue due to several emerging trends.

- The rise of mobile wallets and digital currencies Mobile wallets, which allow users to store and manage their payment information on their mobile devices, have become increasingly popular in recent years. Many major tech companies, such as Apple, Google, and Samsung, have their own mobile wallet offerings, and this trend is likely to continue. Digital currencies, such as Bitcoin and Ethereum, are also becoming more widely accepted as a form of payment, and their integration with mobile wallets is expected to increase in the future.

- The impact of biometric authentication on mobile payments Biometric authentication, such as fingerprint scanning or facial recognition, has already been widely adopted in mobile devices. This technology is also being integrated into mobile payments, allowing for a more secure and streamlined payment experience. As biometric technology continues to improve, it is likely to become the standard for mobile payments.

- The role of mobile payments in the growth of e-commerce E-commerce has been growing rapidly in recent years, and mobile payments have played a significant role in this growth. Mobile devices have made it easier for consumers to make purchases from anywhere at any time, and mobile payments have made the checkout process faster and more convenient. As e-commerce continues to grow, mobile payments are expected to become even more important.

Mobile payments have become an essential part of the modern economy, and their impact on society is undeniable. With the rise of mobile wallets and digital currencies, biometric authentication, and the role of mobile payments in e-commerce, the potential for growth in this area is immense.

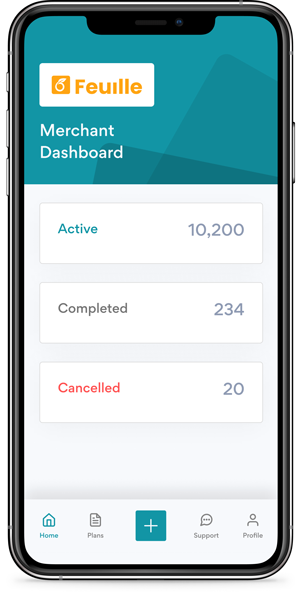

This is where LayUp comes in.

By enabling businesses with recurring payment technology, LayUp offers a value-added service that can help them stay ahead in the increasingly competitive world of mobile payments. As technology continues to evolve, LayUp’s innovative solutions will help businesses keep pace with the latest trends and provide their customers with the best possible experience. As we continue to embrace mobile payments, LayUp’s services will be vital in ensuring that they are accessible, secure, and convenient for everyone.

For more on our pioneering lay-by solutions built for enterprise and SMEs, click here.