As the world moves further into a digital era, consumer behaviour is shifting. The traditional “buy now, pay later” model has been replaced by an increasingly popular “save now, buy later” approach to payment. The emergence of lay-by plans and services are allowing shoppers to spread out their payments over time while still being able to purchase the goods they want. The potential for technological advancements in this area is endless, and businesses of all sizes are taking advantage of the opportunities that lay-by plans provide.

In this article, we’ll delve deeper into how this revolutionary payment structure – and the tech it’s using – is opening up stronger streams of revenue for businesses.

What is a save now, buy later lay-by plan in business?

Lay-by plans, also known as save now, buy later plans, are payment agreements that allow customers to purchase goods or services over a certain amount of time. Through lay-by plans, businesses provide their customers with the option to pay for items in instalments instead of having to pay the full price upfront. This allows customers to spread out the cost of the item over several weeks or months, which can help them better manage their budgets.

Customers who choose to use lay-by plans make a series of payments that are secured by the business until they have paid off the full amount and received their goods or services. Businesses using lay-by plans benefit from improved cash flow as well as building relationships with their customers.

Overall, save now, buy later lay-by plans are a great option for businesses and customers alike as they provide an easy and convenient way to purchase goods or services without having to pay the full price upfront. This payment option can help grow customer loyalty and revenue for the business.

A great example of this is how expensive dentistry can be financed upfront using LayUp.

Impact of technology on the future of “save now, buy later” plans

The Impact of technology on the future of “save now, buy later” lay-by plans is an important issue to consider as it has a significant influence on how we approach our finances. Lay-by plans are a way for customers to purchase items without having to pay full price upfront; instead, they can spread their payments over time.

Technology has revolutionised this type of purchase by allowing customers to make payments digitally and often through their own mobile devices. This makes it easier and more convenient for customers to manage their lay-by plans and ensures that payment dates and amounts are accurately tracked.

Examples of how technology is already changing the “save now, buy later” game

Overall, the impact of technology on the future of save now, buy later lay-by plans is expected to be positive as it provides customers with more options for budgeting and saving, as well as providing access to products with lower fees.

With these features in place, customers can become smarter shoppers and make better-informed decisions when it comes to laying away goods or services they want but may not necessarily need right away.

Here are a few examples of how technology is already changing the “save now, buy later” game:

Digital wallets and cashback apps

Digital wallets and cashback apps allow users to store money in a secure place as well as track spending patterns and accumulate rewards for purchases made through the app.

Online investment platforms

Creating online investment platforms provides access to products with lower fees than traditional investments, such as stocks or bonds. These platforms also offer automated investing options which make it easy for users to build wealth over time while still maintaining control over their portfolios.

Smart budgeting and saving tools

Smart budgeting tools help users plan ahead financially so they can set aside money each month towards specific goals such as saving for retirement or buying a home in the near future. Additionally, these tools have built-in savings capabilities so users can automatically transfer funds from their checking accounts into savings accounts based on predetermined criteria such as income level or total balance in one’s account at any given time period.

Virtual reality shopping experiences

Enabling shoppers to virtually try before they buy, is a great piece of influencing tech in shopping. This will allow users to experience a product from all angles without having to actually purchase it until they’re sure they like it. As a result, this would enable customers to make better informed decisions regarding what items they choose to add to their layaway and also reduce impulse purchases – customers can take the time needed in order to consider their options thoroughly. Additionally, virtual reality shopping experiences can help reduce the amount of returns since shoppers already have an idea of how products look and feel prior to purchase which leads to fewer regrets when going through with the actual purchase. In turn, this will help to maximise the customer’s satisfaction with their purchases and ensure that any items added to layaway are done so responsibly.

LayUp’s lay-by offering as an example of technology innovation in the field

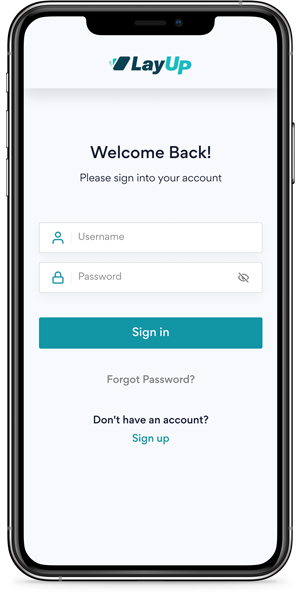

LayUp has been recognised as an example of technological innovation in the retail field due to its unique lay-by offering. LayUp is a revolutionary consumer financial product that enables customers to make secure payments over time for a product they want, without having to pay the entire cost upfront.

LayUp’s mobile and online based platform allows customers to sign-up and pay for a product in instalments, without having to worry about the need for credit checks or interest fees. LayUp also offers customers the chance to pause payments should they need to, giving them peace of mind and an extra layer of flexibility when managing their finances.

Ultimately LayUp is providing a technology-driven solution that caters to customer’s needs in a convenient, accessible and secure way.