The financial services sector is experiencing a significant shift due to the rapid progress of technology and the rise of innovative solutions.

Financial technology, or fintech, has catalysed considerable change in the banking sector, offering innovative technologies and services that impact how banks conduct business. As fintech transforms traditional banking and economic practices, players in the industry face both opportunities and challenges. To be competitive in today’s economy, banks must embrace the fintech revolution or risk falling behind.

After decades of hypergrowth, fintechs have officially entered a new era of value, focusing on sustainable, profitable growth. Let’s delve into the financial system’s core, explore why it’s ripe for disruption, and analyse the landscape where competition and cooperation interplay.

ALSO READ: The Rise of Fintech: How Technology is Transforming Business Finance

1. Understanding the Financial System: A Closer Look

The financial system, a complex network of institutions, processes, and markets, has long been the backbone of economic activity. It encompasses banks, regulatory entities, payment systems, and more, working together to facilitate transactions. However, the traditional financial ecosystem has challenges, including inefficiencies, barriers to access, and a need for agility in adapting to evolving consumer needs.

2. The Opening for Disruption: Why Fintech Matters

Enter fintech – a disruptive force reshaping the financial landscape. Fintech leverages technology to create innovative solutions that challenge traditional banking. From mobile payments and blockchain to robo-advisors and peer-to-peer lending, fintech introduces efficiency, accessibility, and user-centricity to an industry that has often lagged in technological adoption.

“Fintech is set to have a lasting impact on how consumers pay for goods and services. Slowly, we are moving away from traditional banking transactions utilising cash or credit cards, opting instead for smart devices and contactless transactions.” – Richard Summerfield, Financier Worldwide

3. The Competitive Landscape: A Crowded Space

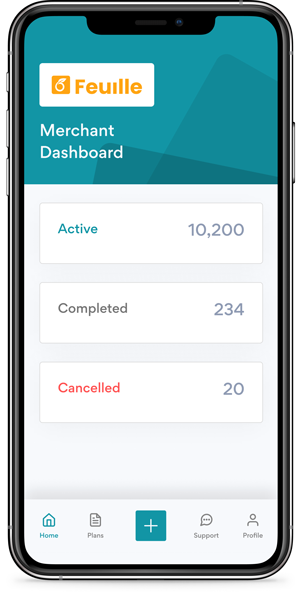

As fintech disruptors emerge – and, dare we say, start to dominate – a crowded space develops with various players vying for market share. The result is fierce competition focusing on providing faster, more accessible, and cost-effective financial services to consumers and businesses alike. Startups like LayUp, established financial institutions, and tech giants are among the fray.

4. Collaboration Amidst Competition: Fintech’s Unique Dynamics

While competition is ingrained, fintech also thrives on collaboration. Collectively, there’s a need to move into a space of cooperation, a means of pulling together in the right direction. Getting this right will open the door for even more market opportunities, reach, and returns.

The industry recognises that no single entity can provide an all-encompassing solution, so partnerships between traditional banks and fintech startups and collaborations among fintech players are becoming increasingly common.

“These partnerships leverage each participant’s strengths, fostering a symbiotic relationship that enhances the financial ecosystem.” – Nima Torabi, The Decoupled Era

ALSO READ: How LayUp Technologies and Newland Terminals are Transforming Business Transactions

5. Key Trends Shaping the Future of Fintech

Looking forward, several trends will shape fintech’s trajectory. The rise of decentralised finance (DeFi), the integration of artificial intelligence for personalised financial services, and the exploration of blockchain technology for enhanced security are just a few. Regulatory frameworks also play a crucial role in shaping the industry, balancing innovation with consumer protection.

ALSO READ: Revolutionising Finance: The Potential Impact of Decentralised Finance (DeFi) in South Africa

The financial system is amid a transformative journey led by fintech, a disruptive force. As the industry navigates this landscape of competition and collaboration, it paves the way for a more inclusive, efficient, and tech-driven financial future. As players in this field, we at LayUp Technologies watch on as fintech continues to redefine the game’s rules, creating opportunities and challenges that will shape the economic world in the future.

Trusted by over 1,000+ partners, LayUp’s zero-interest payment solutions are making waves in business. Curious about our offerings? Reach out to learn more.

ALSO READ: The Future of Fintech in Retail: Leveraging Lay-By Payments for Business Growth