A new study from Juniper Research has found that open banking payments transaction values will exceed $330 billion globally by 2027, up from $57 billion in 2023. Industry players are propelling such growth by developing new use cases, recurring payments being one whose potential is yet to be fully unlocked in Africa.

South African retailers, banks, and consumers rely heavily on direct debits for regular payments, with an average of 31 million monthly transactions. Despite this, the question arises: Why should merchants and banks transition to recurring payments?

Debit Versus Recurring Payments

With open banking, a payment initiation service provider (PISP) manages access to the customer’s bank account to transfer funds. Recurring payments use a PISP to set up these payments with specific rules and constraints. With a direct debit system, a business can pull the regular payments based on pre-authorisation from the customer.

Recurring payments differ in following a push-based model that utilises open banking to provide centralised consent to pay. This method is beneficial because it places the customer at the core of the transaction.

Traditionally, setting up a recurring payment required a time-consuming process involving paperwork, account information or card details, bank approval, and Debicheck. This process could take several days or weeks, and changes to the payment schedule or amount typically require additional paperwork and approvals, leading to missed payments, overdrafts, and other financial inconsistencies.

The Current State of Recurring Payments in Africa

In countries like Kenya, where mobile money services like M-PESA have revolutionised financial transactions, there is a growing acceptance of recurring payments for services such as utility bills, insurance premiums, and subscription-based services. Similarly, in South Africa, debit orders are used for recurring payments, particularly in industries like telecommunications and utilities.

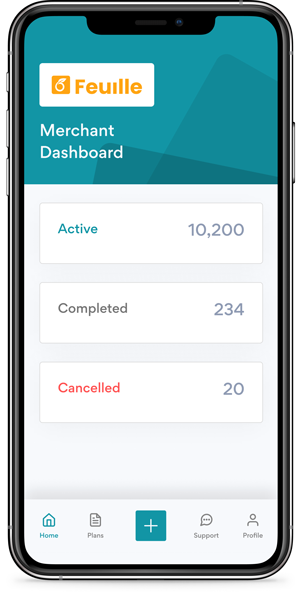

In the South African context, LayUp Technologies advances recurring payments by offering innovative solutions that cater to the evolving needs of consumers and businesses alike. As a provider of payment technology, LayUp facilitates seamless recurring payments, empowering businesses to automate regular transactions and customers to enjoy convenient payment experiences.

Through LayUp’s platform, businesses can set up recurring billing cycles for various services, such as subscriptions, services, utilities, and more. This automation streamlines administrative processes and ensures consistent cash flow for businesses.

Factors Driving the Future Growth of Recurring Payments

Among others, four main factors contribute to the future of recurring payments in Africa:

- Rise of Digital Infrastructure

With the expansion of internet connectivity and the proliferation of smartphones, more Africans have access to digital payment platforms. This digital infrastructure forms the foundation for the adoption of recurring payments.

2. Changing Consumer Preferences

As consumers increasingly look for convenience and flexibility in managing their finances, there is a growing demand for automated payment solutions. Recurring payments offer a hassle-free way to handle day-to-day expenses, aligning with modern consumers’ preferences.

3. Financial Inclusion Initiatives

Governments and financial institutions across Africa, including LayUp, are prioritising initiatives to promote financial inclusion. These empower underserved populations to participate more actively in the economy by providing access to digital payment platforms and encouraging recurring payments.

4. Business Efficiency and Revenue Growth

For businesses, recurring payments offer numerous benefits, including improved cash flow management, reduced administrative costs, and enhanced customer retention. Companies can streamline operations and unlock new revenue streams by embracing recurring payment models.

Challenges and Opportunities

Despite the positive outlook, the future of recurring payments in Africa also presents challenges. Concerns around cybersecurity, data privacy, and regulatory compliance must be addressed to ensure the integrity and security of digital payment systems. Additionally, there is a need for greater collaboration among stakeholders, including governments, financial institutions, and technology providers, to drive innovation and address evident barriers.

However, these challenges are accompanied by vast opportunities. As Africa continues to urbanise and digitise, the potential for growth in recurring payments is immense. By leveraging innovative technologies such as blockchain, artificial intelligence, and biometric authentication, Africa can leapfrog traditional banking infrastructures and emerge as a leader in the realm of digital payments.

The future of recurring payments in Africa is one of promise and possibility. As the continent embraces digital transformation and innovative payment solutions, recurring payments are poised to play a central role in shaping the future of finance. By fostering collaboration, innovation, and inclusivity, Africa can unlock the full potential of recurring payments, driving economic growth, empowering communities, and transforming lives across the continent.