Save now, buy later is a simple yet effective money-saving technique that can help you make your money go further. It allows you to put aside funds for future purchases and pay them off in instalments over time, rather than paying for the item in full upfront. By doing this, you can save yourself from costly interest payments or late fees on large purchases and take advantage of better deals when they come along. Save now, buy later gives you the freedom to invest your hard-earned cash wisely and enjoy more financial security in the long run.

And, at the end of the instalment period, the goods are yours – no other debt, no interest and no more payments due.

Here’s how it works.

What is save now, buy later?

Save now, buy later is a purchasing option in which customers can reserve items for purchase by making small payments over time. It allows customers to secure the things they want quickly and conveniently without the need to pay the full amount upfront. The customer pays off the item gradually until they have made all of the necessary payments and then receive their product. This payment plan gives individuals access to products that may have been previously out of reach due to financial constraints.

Save now, buy later is an excellent way to spread costs out over a period of time and make purchases more manageable while avoiding high interest fees associated with credit cards or other loan options.

In summary, save now, buy later offers a flexible payment option for customers who are looking to purchase products without making a large upfront payment. It provides access to high-end items while allowing individuals to make smaller payments spread out over time. With this purchasing option, customers can enjoy their items with peace of mind knowing that their product is safely secured until full payment has been made.

You might also want to learn more about Recurring Billing

How are the payments structured for save money now, pay later?

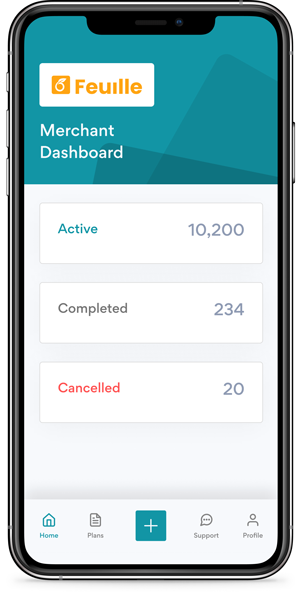

Save money now, pay later in lay-by offers customers the flexibility to buy products with a deferred payment plan. Depending on the retailer and product, customers can either pay the full amount up front or make regular payments over a period of time until they have paid off their purchase in full.

For example, at some retailers customers may be required to pay 25% of the total cost upfront and then divide the remaining balance into 4 equal payments due every two weeks. Other retailers might offer an initial 10% down payment with 8 further cash instalments every two weeks for a total of 9 payments.

These are just two possible options – ultimately the payment structure will depend on the business, the product offer, and the agreed-upon terms.

Overall, save money now, pay later in lay-by is an effective way to spread out payments over time and make large purchases more manageable.

Are there any fees associated with save now, buy later?

There are no additional interest or service fees associated with this type of payment plan, ensuring that you only pay for what you agreed to at the start. This makes save now, buy later an attractive option for those looking to finance larger purchases over time without paying extra.

Why is save now, buy later important for the consumer?

Save now, buy later is a great way to make sure that you are able to buy what you need while still staying within your budget. This type of financing allows you to spread the cost of a purchase over time with either fixed monthly payments or flexible payment options. How it works is simple: the customer pays an initial down payment and then makes regular payments until the full amount of their purchase has been paid off.

Why is this a better way to shop?

Better for your budget

The main benefit for consumers when using save now, buy later is that it helps them budget better by allowing them to structure their payments in a way that fits their financial situation. Because there are no hidden fees or interest charges associated with this type of financing, customers can rest assured knowing they will only be paying for what they purchased. How the payments are structured varies from provider to provider, and can include fixed monthly payments or more flexible payment options such as weekly or bi-weekly payments.

Spreading costs

Save now, buy later is an ideal option for those who may not be able to afford a large purchase outright, but still need the item right away. It’s also a great option for those who want to take advantage of sales or promotions and spread out their costs over time. With save now, buy later financing plans, consumers can get what they need while still staying within their budget.

Are there any limitations on the number of save now, buy later options one can use?

The payment structure for save now, buy later options can vary from provider to provider. Generally, it involves a one-time upfront fee or a series of instalments that are paid over time. Some providers also offer the option of interest-free payments stretched out over several months or years.

No rules, but think first before you buy

There is no standard rule when it comes to the number of save now, pay later options that you can use at once. Ultimately, it depends on your financial situation and your ability to manage multiple debt obligations. It’s important to keep in mind that taking on too much debt can be risky, so make sure to assess your current situation before signing up for any additional services.

Research, consider the risk, and understand the terms

With any financial decision, it is also important to consider the potential risks involved. Make sure you understand the payment terms that come with any product or service before signing up for an offer. Doing your research ahead of time will help ensure you make smart decisions about your money. Regardless of how many save now, pay later options you decide to sign up for, understanding the details and staying informed will help you make sound financial choices in the long run.

Save money now and buy later is an attractive option for many shoppers, especially those who have limited funds. How it works in lay-by can be quite simple – customers make payments over a period of time until the product is fully paid off. This allows them to purchase items they otherwise couldn’t afford without having to worry about large upfront costs or interest charges. If you’re looking for more affordable ways to shop, save money now and buy later may just be your perfect solution.

And LayUp is your perfect shopping partner in everything lay-by – click here to sign up.