Shopping for the things you really want, should always be fun. Sometimes, though, thinking about spending, and possibly putting yourself into debt – especially if you don’t really have the cash – can hold you back from the enjoyment of shopping.

There’s a better way – the lay-by online.

Is lay-bying online a good idea?

Credit and debt can be scary concepts. The problem is, having a credit record is important, but so is managing debt so that it never becomes overwhelming. And then there’s the issue of wanting to buy nice things. There’s a way, though, to both enjoy the fun of shopping and buying, and to build a great-looking credit history at the same time. And that’s by lay-bying.

Why?

The lay-by allows shoppers to take their time when making purchases, as they can spread out their payments over a period of time. This also helps them avoid overspending or accumulating too much debt. Additionally, the retail lay-by offers peace of mind for customers, as they are not required to pay for items upfront and can rest assured that their purchase will be reserved until they have paid in full.

It’s simply a savvy and sensible way to get the things you want, without incurring debt, or getting stuck with credit you can’t actually control.

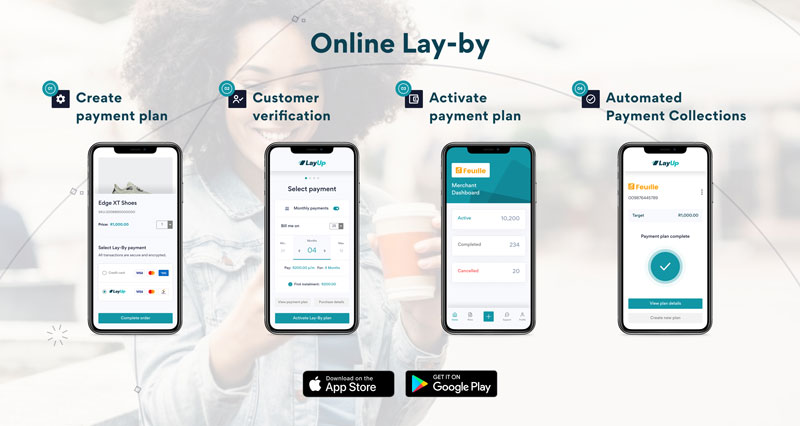

How to lay-by online

When shopping online, it’s important to know how to lay-by your purchases. This involves choosing an item you wish to buy, selecting the “lay-by” option at checkout, and making regular payments until the full purchase price has been paid.

key steps to laying-by online successfully

Be sensible

First, you should choose items that are within your budget and that you know you will be able to pay for in full by the end of the lay-by period. You should also have a clear understanding of any fees or charges associated with your lay-by, such as cancellation fees or interest costs.

Make those payments – regularly

Once you’ve selected all of your items and entered payment details, it’s time to make regular payments. Typically, you will be required to make at least one payment every 30 days until the full purchase price is paid. Some sellers may also require that you pay a deposit upfront before your items can be added to your lay-by account.

Keep the paperwork

It’s important to stay organised when it comes to paying off your online lay-by. You should always save or print out confirmation emails from your seller, so you have a record of what has been purchased and how much you still owe. And if you ever need to cancel your lay-by for any reason, it’s best to do so as soon as possible, as there may be cancellation fees or other charges associated with early termination.

If you’re looking for reliable, hassle-free online shopping, lay-bys can be a great option. Just remember to stay organised and communicate with your seller throughout the process so you can stay on track and get your items delivered as quickly as possible.

What do LayUp’s lay-bys offer?

LayUp’s retail lay-bys are a convenient and easy way to shop, offering customers the flexibility to pay off their purchases over time. Our lay-bys offer a variety of payment options, including monthly instalments or weekly payments, making them an ideal choice for anyone who needs more time to pay for their purchases. Additionally, our lay-bys are designed with your convenience in mind, allowing you to pick up and return your items at any time without incurring additional fees or charges – split the cost at your favourite store, pay overtime, interest-free and debt-free.

It’s simply a way to click ‘Buy’ without financial worry putting a dampener on the fun.

To sign up with LayUp, shop our partners and get the things you want – and without the debt – click here.