The subscription economy in South Africa is rapidly expanding; nearly half of South African households are now enrolled in subscription services.

South Africa has 7.2 million active subscriptions, contributing to a global subscription economy valued at $530 million. Projections indicate that by 2025, this figure will surpass $820 million. These statistics are evidence that the subscription economy in South Africa is on the rise and is here to stay.

With ever-evolving technologies, emerging trends, and changing consumer behaviours, retail businesses must adopt effective strategies that keep them ahead of the competition, attracting customers and retaining them in the long run. One such strategy that has gained traction is the adoption of subscription services. From streaming platforms to meal kit deliveries and software-as-a-service (SaaS) offerings, subscription-based models have impacted how companies engage with their customers while unlocking many benefits for both parties involved. Recurring revenue, facilitated through subscription services, is highly effective for businesses for several reasons:

ALSO READ: The Future of Subscription Services: How to Stay Ahead of the Game

1. Predictable Revenue Streams

One of the most significant advantages of subscription services is the assurance of a predictable revenue stream. Unlike traditional one-time purchases, which often result in sporadic income, recurring billing allows businesses to forecast revenue more accurately. This enables companies to make informed decisions regarding budgeting and resource allocation, not to mention long-term strategic planning, fostering increased sustainability and growth.

Real-world example

Netflix, a leader in the streaming industry, generates a substantial portion of its revenue through monthly subscription fees. With millions of subscribers worldwide opting for the convenience and extensive content library the platform offers, the subscription fees contribute substantially to Netflix’s financial success. Leveraging this subscription-based model empowers the company to invest in original content creation, expand its global reach, and stay ahead of competitors.

2. Improved Customer Experience/Retention:

Subscription services enable businesses to deliver a personalised and tailored customer experience. Customers can enjoy continuous value without repetitive transactions by offering a seamless and hassle-free way to access products or services. This, in turn, enhances the overall customer experience and encourages long-term engagement and loyalty.

Real-world example

Rentoza, a South African e-commerce platform, offers a unique twist on retailing electronics, appliances, baby goods, and fitness equipment. Rather than traditional sales, Rentoza operates on a subscription model akin to popular services like Netflix and Spotify. Customers gain access to a wide range of products and can use them for as little as one month before returning them at their convenience. This customer-centric approach has resulted in impressive retention rates and propelled the company to success.

3. Enhanced Upselling and Cross-Selling Opportunities

Subscription-based models offer a framework for upselling and cross-selling opportunities. As customers interact with a brand over time, businesses can introduce additional products or premium subscription tiers, effectively enhancing the lifetime value of each customer and maximising revenue potential. Companies can tailor personalised recommendations and promotions by analysing customer preferences and behaviour, driving additional sales and increasing customer lifetime value.

Real-world example

Amazon Prime typifies upselling and cross-selling within a subscription ecosystem. It offers fast shipping and access to exclusive deals, and Amazon Prime members are also incentivised to explore added services such as Prime Video, Prime Music, and Prime Reading. This bundled approach enhances the overall value proposition and encourages members to upgrade their subscriptions for an all-inclusive experience.

4. Scalability and Flexibility

Subscription models offer scalability and flexibility, allowing businesses to adjust offerings, pricing tiers, and features to meet evolving customer needs and market demands. Whether scaling operations to accommodate a growing subscriber base or introducing new subscription tiers to cater to diverse segments, businesses can quickly adapt their subscription strategies to drive growth and innovation.

Real-world example

Adobe Creative Cloud revolutionised the software industry by transitioning from perpetual licenses to subscriptions. This shift gave customers affordable access to industry-leading creative tools and enabled Adobe to introduce flexible subscription plans tailored to different user segments. As a result, Adobe witnessed significant revenue growth and expanded its customer base worldwide.

5. Data-Driven Insights

Subscription models inherently generate a wealth of data about customer behaviour and preferences. This data can be invaluable for making informed business decisions. By analysing subscriber data, companies can gain insights into customer habits, content preferences, and engagement patterns. With this information, businesses can use data-driven decision-making to refine their offerings, marketing strategies, and content to align with customer needs more precisely. By harnessing advanced analytics and metrics, businesses can refine their subscription offerings, optimise pricing strategies, and personalise marketing efforts to drive customer acquisition and retention.

Real-world example

Spotify utilises data-driven insights to deliver subscribers personalised recommendations and curated playlists. By analysing listening habits, genre preferences, and user interactions, Spotify enhances the music discovery experience, keeping subscribers engaged and satisfied. Additionally, Spotify leverages data to optimise its advertising revenue model and forge strategic partnerships with artists and labels.

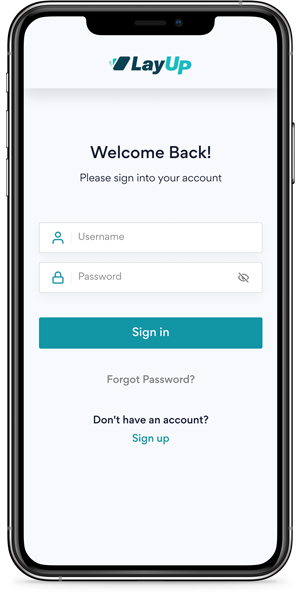

Leverage LayUp’s Smart Subscription Model

LayUp Technologies’ subscription model allows businesses to manage recurring payments, offering seamless subscriptions and convenient collection methods for memberships, services, or ongoing product offerings. With LayUp, partnered merchants can effortlessly create flexible payment plans tailored to their customer’s needs, allowing for personalised options and a straightforward setup process.

- Customers quickly benefit from a seamless experience, managing their subscriptions directly from their dashboard.

- LayUp ensures fast and easy sign-ups, simplifying the process with personalised payment options and intuitive setup procedures.

- Moreover, LayUp’s flexible payment system empowers customers to modify subscription terms, including frequency, duration, and cancellation, providing flexibility.

- By automating payment collection and streamlining manual procedures, LayUp minimises the risk of failed payments, ensuring a smooth and uninterrupted subscription experience for businesses and customers.

Key tech features include easy integration with existing software, automated reporting, tracking, and reconciliation, free software licensing, and comprehensive management of the customer journey, making LayUp the ultimate digital payments solution for businesses of all sizes.

ALSO READ: The Evolution of Payments: A Guide to Variable Recurring Payments (VRPs) in 2024

In summary, the power of recurring revenue through subscription services is evidential. From predictable revenue streams and improved customer experience to enhanced upselling opportunities and data-driven insights, subscription models offer myriad benefits for businesses seeking sustained growth and profitability in today’s competitive market landscape. By embracing subscription-based strategies and leveraging real-world examples, companies can unlock new avenues for success while delivering unparalleled value to their customers.