Lay-by payment options, also known as layaway services, provide you with a unique opportunity to improve your financial literacy. These services enable you to reserve products or services and pay for them in instalments over time, without the burden of high interest rates or credit checks. You also get financial flexibility and budgeting control. Here’s how lay-by payment options benefit you:

- Budget-Friendly Purchases

Lay-bys allow you to reserve products and make payments over time. This means you can acquire expensive items without depleting your savings or using credit. It’s a budget-friendly way to manage large purchases.

2. Interest-free or Low-Cost

Lay-by plans typically don’t involve interest charges. You only pay the agreed-upon price of the item, avoiding the high interest rates associated with credit card purchases.

3. No Credit Checks

Unlike credit or financing options, lay-bys generally don’t require credit checks. This makes them accessible to a broader range of consumers, including those with varying credit histories.

4. Financial Discipline

Lay-bys encourage financial discipline. You commit to making regular payments, which fosters responsibility and accountability. It’s an excellent way to develop good financial habits.

5. Avoiding Debt

Lay-bys enable you to avoid accumulating debt, as you’re paying for your purchases incrementally. This reduces the risk of falling into a cycle of debt that often accompanies credit card use.

6. Ownership Upon Full Payment

You have the peace of mind that your chosen items are reserved for you. Once the final payment is made, you take possession of the products, with no additional strings attached.

7. Flexible Payment Terms

Lay-bys often allow you to choose your payment schedule, such as weekly or monthly payments. This flexibility caters to various financial situations.

8. Transparent Terms and Conditions

Lay-by payment plans typically provide clear and transparent terms and conditions. You can easily understand your financial commitments, avoiding hidden fees or surprise charges.

9. Risk Mitigation

Lay-bys reduce the risk of making impulsive purchases. You have time to think through your buying decisions and can cancel the lay-by if necessary, often with a refund of payments (though there may be some cancellation fees).

10. Access to Desirable Items

Lay-bys allow you to acquire desirable items that may have been financially out of reach without the option to spread out payments.

In summary, lay-by payment options empower you by providing a financially responsible and accessible way to purchase desired items. They offer you control over your budgets, promote financial discipline, and enable you to acquire items without resorting to credit or incurring high-interest charges.

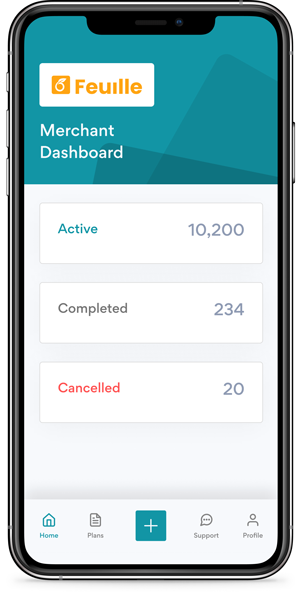

Ready to get started with LayUp? Sign up here.