In a rapidly evolving digital age, the landscape of financial services is changing dramatically. Traditional banking and payment systems are being reshaped by innovative fintech solutions, opening doors to financial inclusion for individuals and businesses previously underserved by the financial sector. One such transformative solution is the lay-by payment system. Its role in promoting financial inclusion cannot be overstated.

The Challenge of Financial Inclusion

Financial inclusion, defined as providing access to affordable and convenient financial services for all, is a global imperative. Millions of people worldwide, including large segments of the population in countries like South Africa, have historically been excluded from the formal financial system. This exclusion stems from various factors, including limited access to traditional banking infrastructure, lack of credit history, and income disparities.

Without access to basic financial services, individuals face significant challenges in managing their finances, saving for the future, and participating in economic activities. Financial exclusion perpetuates poverty and limits opportunities for personal and economic advancement.

The Lay-By Payment Solution: A Path to Inclusion

Lay-by payment solutions have emerged as a powerful tool to address the barriers to financial inclusion. Traditionally associated with retail purchases, lay-by systems allow consumers to reserve products and pay for them over time through instalment payments. While this concept is not new, digital transformation has revitalised its potential and expanded its reach.

Here’s how lay-by payment solutions contribute to financial inclusion:

- Access to Goods and Services: Lay-by payments enable individuals with limited access to credit to acquire essential goods and services. From electronics to furniture and clothing, lay-by options offer a way for people to obtain items they need without the immediate burden of a large upfront payment.

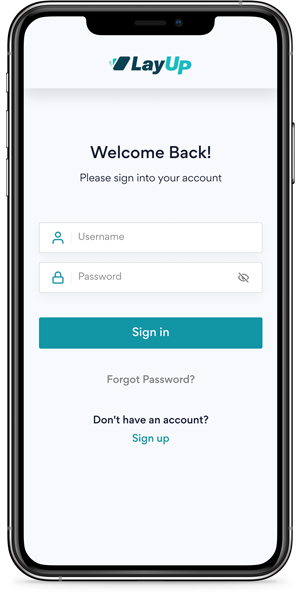

- No Credit Check Required: Unlike traditional credit-based financing, lay-by payment solutions like LayUp do not require a credit check. This makes them accessible to those without established credit histories or with less-than-perfect credit scores.

- Flexible Payment Plans: Lay-by systems offer flexible repayment schedules, allowing customers to choose terms that align with their financial capabilities. This flexibility accommodates various income levels and ensures affordability.

- Digital Accessibility: The digitalisation of lay-by payment systems has made them accessible to a wider audience. Mobile apps and online platforms make it easy for individuals to initiate and manage lay-by purchases from the comfort of their smartphones.

The South African Context

South Africa, with its diverse population and economic disparities, is a prime example of a country benefiting from lay-by payment solutions in promoting financial inclusion. Many South Africans, especially in rural and lower-income areas, face challenges accessing formal banking services. Lay-by payments provide them with an alternative means to participate in the economy and improve their quality of life.

Lay-by payment solutions have emerged as a catalyst for financial inclusion in the digital age. By offering accessible and flexible options for purchasing essential goods and services, these systems empower individuals and businesses, particularly in underserved markets like South Africa. As fintech continues to innovate, lay-by payment solutions like LayUp are likely to play an even more significant role in promoting financial inclusion and expanding economic opportunities for all.